Thinking about diving into multifamily real estate? Great call it’s one of the most powerful ways to build long-term wealth. But before you leap, there’s one big question to answer:

Do you want to be hands-on or hands-off?

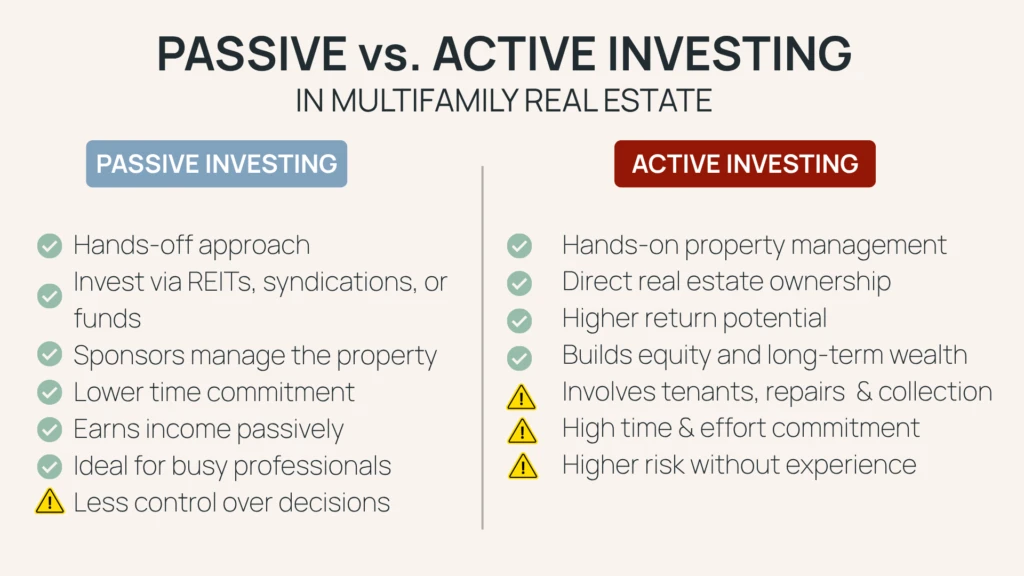

That’s the real difference between active and passive investing in multifamily real estate. One puts you in the driver’s seat for everything; the other lets you ride along and collect the returns without the stress of management.

Let’s break down what each path really looks like so you can decide what fits your lifestyle, goals, and risk tolerance best.

What’s Active Investing, Really?

Ever dreamed of owning an apartment building and calling the shots? That’s active investing. You’re not just writing a check you’re the CEO of the whole operation.

✅ You scout and buy the property.

✅ You oversee renovations and manage contractors.

✅ You handle tenants, collections, repairs, leasing, and finances.

It’s rewarding but it’s work. Think 20–40 hours a week during acquisitions or renovations. You’ll also need upfront capital: buying a $2M property might require $500K+ in equity, plus reserves for emergencies and improvements.

Active investing isn’t for the faint of heart, but if you want full control and higher potential returns, it may be the path for you.

What’s Passive Investing?

Now, what if you could invest in multifamily without worrying about leaky roofs, midnight tenant calls, or finding good contractors?

That’s passive investing. You invest your capital—usually $50K to $100K—and let experienced operators (called sponsors) handle the day-to-day. These are typically done through real estate syndications or funds.

You still own a piece of the deal (often as a limited partner), and you earn returns, receive distributions, and benefit from tax advantages just without the headaches.

It’s ideal for busy professionals who want to build wealth without adding a second job title.

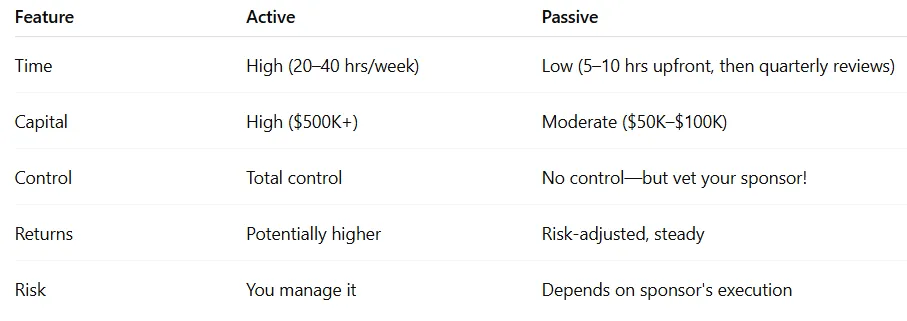

Quick Comparison: Active vs. Passive

What About the Tax Benefits?

Whether you’re active or passive, real estate offers amazing tax perks—especially depreciation and cost segregation.

📉 Active investors can hire CPAs and engineers to optimize depreciation for cost segregation. studies

📉 Passive investors benefit too, many sponsors do this work and pass the benefits through via K-1s.

If you’re a high-income earner, these tax advantages can seriously boost your after-tax returns.

The Risk Side (Because Let’s Be Real…)

No investment is risk-free—but the type of risk you face is different.

Active investors take on operational, market, and management risk. You’re in control, but that means the buck stops with you.

Passive investors face sponsor risk. If your sponsor underperforms, so do your returns. That’s why vetting the team’s experience level and track record is non-negotiable.

Diversification can help here: passive investors can spread capital across different sponsors, markets, and asset types something active investors can’t always do at scale.

Which One Is Right for You?

Ask yourself:

- Do I want full control or peace of mind?

- Can I commit time weekly to property operations?

- Am I comfortable risking $500K+ on one asset?

- Do I meet sophisticated or accredited investor criteria (for passive syndications)?

There’s no one-size-fits-all. Some investors go all-in on active. Others start passive and scale. And many do both a hybrid approach that offers control and diversification.

Pro Tips to Win (Whichever Path You Choose)

If you’re going active:

- Study your market like your retirement depends on it.

- Build a strong team property manager, contractor, CPA, attorney.

- Stay conservative in your underwriting. Always.

If you’re going passive:

- Vet your sponsor: track record, transparency, and skin in the game.

- Diversify across 3–5 deals before going big.

- Read the offering documents (yes, all of them).

Multifamily real estate isn’t just for tycoons and hedge funds. Whether you’re ready to buy your first 12-unit or write a check into a 200-unit syndication, the most important step is this:

Start.

Then stay consistent, keep learning, and align your investing style with your lifestyle. Over time, you’ll build not just a portfolio but freedom, security, and wealth that lasts.

Ready to explore passive investment opportunities or learn more about building your multifamily portfolio?

We help investors like you navigate both active and passive strategies with confidence. contact us to review the latest offerings and see what’s possible when real estate works for you.