For multifamily investors and operators, understanding Chicago’s zoning laws is more than just a regulatory checkbox—it’s a strategic advantage. Zoning dictates what you can build, how many units you can operate, and how much long-term value you can extract from a property. The investors who study zoning codes and understand how to use them position themselves to maximize returns and minimize costly surprises.

This guide covers the essentials of Chicago’s residential zoning, how it influences property values, and how savvy investors are using tools like Transit-Oriented Development (TOD) and upzoning to unlock growth in a competitive market.

Chicago Zoning Fundamentals Every Multifamily Investor Should Know

Chicago’s zoning code divides the city into districts that define how land and buildings can be used. For multifamily investors, zoning determines how many units can be built on a site, how tall a building can be, and what kinds of amenities (like parking) are required.

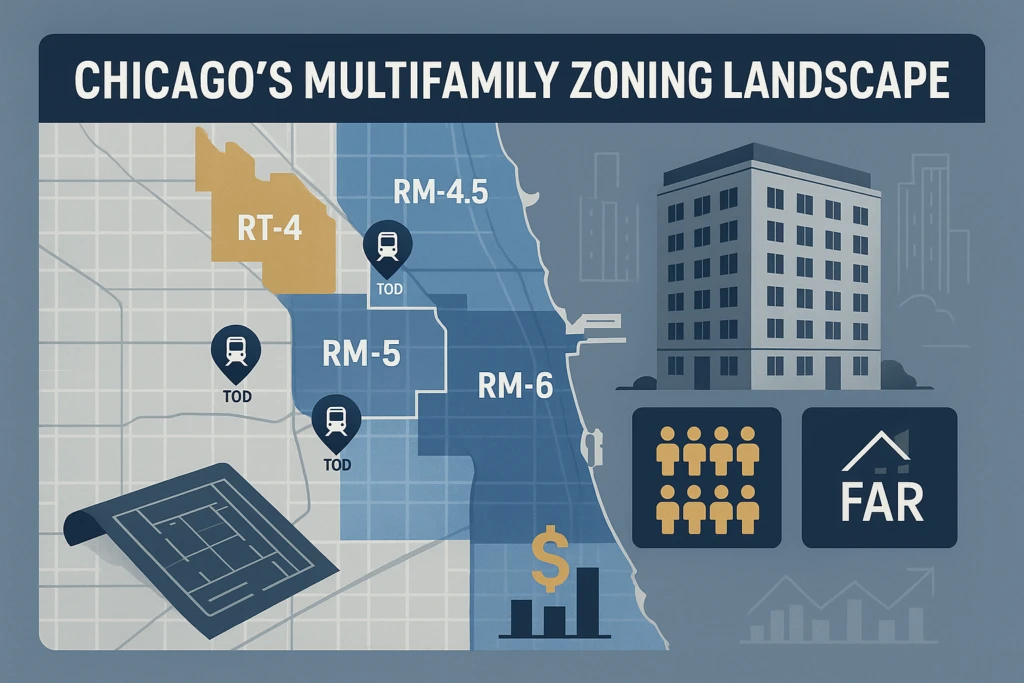

Here are key residential multifamily zoning classifications:

- RT-4 (Residential Two-Flat, Townhouse, Multi-Unit District):

Designed for two-flats, townhomes, and small multi-unit buildings. Requires 1,000 sq ft of lot area per dwelling unit and allows a Floor Area Ratio (FAR) of 1.2. - RM-4.5 (Residential Multi-Unit District):

The entry-level multi-unit zone, requiring 700 sq ft of lot area per dwelling unit with a 1.7 FAR. Common in moderate-density neighborhoods. - RM-5:

Allows denser development with 400 sq ft of lot area per unit and a 2.0 FAR, enabling mid-size multifamily properties in more urban neighborhoods. - RM-6:

Higher-density zone with 300 sq ft of lot area per unit and 4.4 FAR, enabling large-scale multifamily construction. Often found near transit or in dense corridors. - RM-6.5:

The highest-density residential zoning district, offering substantial development potential for experienced operators.

Important Note:

Chicago doesn’t impose a fixed number of units. Instead, the number of allowable units is determined by dividing the lot size by the minimum lot area per unit requirement, subject to FAR limits and other dimensional standards. Overlays and special ordinances, such as TOD and ARO (Affordable Requirements Ordinance), can also modify these base rules.

Read more here: https://secondcityzoning.org/zones/

How Zoning Affects Multifamily Property Values in Chicago

Zoning classification plays a direct role in determining a property’s income potential and therefore its market value.

- Higher-density zones typically allow more units and greater FAR, which translates into increased rental income potential.

- A property zoned RM-6 will often command a premium over an identical building in an RT-4 zone due to its expanded development or repositioning options.

While there is no universal percentage increase for properties with denser zoning, a 2020 study by urban planning expert Yonah Freemark found that Chicago upzoning resulted in statistically significant property value increases—even without immediate new construction. This suggests investors often price in future development potential before any shovel hits the ground.

However, such value increases are context-dependent and can vary widely by neighborhood, access to transit, and development pressure. Investors should run detailed pro forma models factoring in zoning constraints and development timelines.

TOD (Transit-Oriented Development): A Targeted Advantage for Multifamily Investors

Chicago’s Transit-Oriented Development (TOD) program is a powerful zoning overlay that can enhance the value of properties near CTA and Metra stations.

TOD benefits—especially since the 2022 Connected Communities Ordinance—include:

- Density Bonuses: Allowing more dwelling units than normally permitted by the base zoning.

- Reduced Parking Requirements: Less required parking means more leasable space and lower construction costs.

- Administrative Streamlining: Under the 2023 Zoning Modernization Ordinance (2023-5759), certain TOD-related zoning adjustments can be processed faster.

- Stronger Rent Demand: TOD units often attract premium rents due to high demand for car-free living.

But a cautionary note:

Not all properties near transit automatically qualify for TOD incentives. The property must fall within designated TOD boundaries, and the actual benefits vary depending on current zoning and location-specific rules. Administrative approval is often required, especially for projects that seek to go beyond existing entitlements.

A case-in-point is the Wilson Red Line station area. Following the station’s $203 million overhaul completed in 2017–2018, TOD projects have increased in the neighborhood. While anecdotal reports suggest strong lease-up performance, individual investment results vary and should not be generalized without site-specific analysis.

Upzoning in Chicago: How to Spot Value Before It Happens

Upzoning—rezoning a property to allow more density—is one of the most effective ways to unlock hidden value in Chicago real estate.

What makes a strong upzoning candidate?

- Access to Transit and Infrastructure: Neighborhoods already supported by public transportation and utilities are top targets.

- Community and Aldermanic Support: Engaging with local neighborhood groups and aldermen early increases the odds of success.

- Compliance with the Affordable Requirements Ordinance (ARO):

Developers must include affordable housing units or pay in-lieu fees. As of 2024: - 10% affordability is required in most areas

- 20% in “enhanced” zones, including downtown and Community Preservation Areas

- Units must serve households at 60% of Area Median Income (AMI) for rentals and 100% AMI for ownership

While the zoning process has been streamlined in recent years, particularly with Ordinance 2023-5759, complex rezonings can still take 12–18 months, especially when community review is required.

Zoning Compliance: Risks and Penalties Multifamily Investors Must Understand

Non-compliance with zoning laws can result in costly penalties and major disruptions to your investment plan.

Common violations include:

- Exceeding unit limits based on lot size or FAR

- Non-conforming uses (e.g., operating commercial units in residential zones)

- Setback or height violations

- Inadequate parking for the use

Best Practices for Risk Management:

- Always review zoning certificates, site plans, and building permits before acquisition

- Work with experienced zoning attorneys and architects

- Consider specialized insurance for non-conforming or grandfathered properties

Strategic Investment Approaches Based on Zoning Insights

The most successful Chicago multifamily investors use zoning knowledge to inform all stages of investment—from acquisition through exit.

- Zoning-Conscious Value-Add:

Target properties operating below their zoning potential, and explore ways to maximize unit count or floor area within current entitlements. - Diversify by Zoning Classification:

Balance risk and upside by owning a mix of moderate-density (e.g., RM-4.5) and high-density (RM-6 or TOD-eligible) properties. - Pre-Development Positioning:

Acquire sites likely to benefit from future upzoning or TOD incentives before broader market awareness drives prices up. - Exit Strategy Alignment:

Understand how different zoning classifications affect resale appeal. For example, a property in a TOD zone may attract developers willing to pay a premium for future density. - Build Relationships Early:

Successful upzoning and entitlement strategies rely heavily on collaboration with aldermen, community groups, and the city’s Department of Planning and Development.

Conclusion

Chicago’s zoning code isn’t just a legal framework—it’s a roadmap for investment opportunity. From leveraging TOD benefits to executing strategic upzoning plays, multifamily investors who understand the nuances of Chicago zoning gain a true edge in a competitive market.

But the regulatory environment continues to evolve. With major updates like the Connected Communities Ordinance and changes to the ARO in 2024, staying informed is more important than ever. Always verify zoning status through official city sources and consult legal professionals to protect your investment.

Want help navigating zoning-aligned multifamily opportunities in Chicago?

We don’t directly specialize in zoning, but we work closely with trusted consultants who do. Together, we help investors decode Chicago’s complex zoning system and uncover opportunities that support long-term investment strategies. Reach out to learn how a zoning-smart approach can elevate your portfolio.