Let’s cut to the chase: if you’re only looking for multifamily deals on LoopNet or CREXI , you’re missing the real action.

Some of the best apartment buildings—those needle-moving, wealth-building assets—never make it to public platforms. They’re shared quietly, strategically, and often exclusively. And if you’re not in the right circles, you won’t even know they existed.

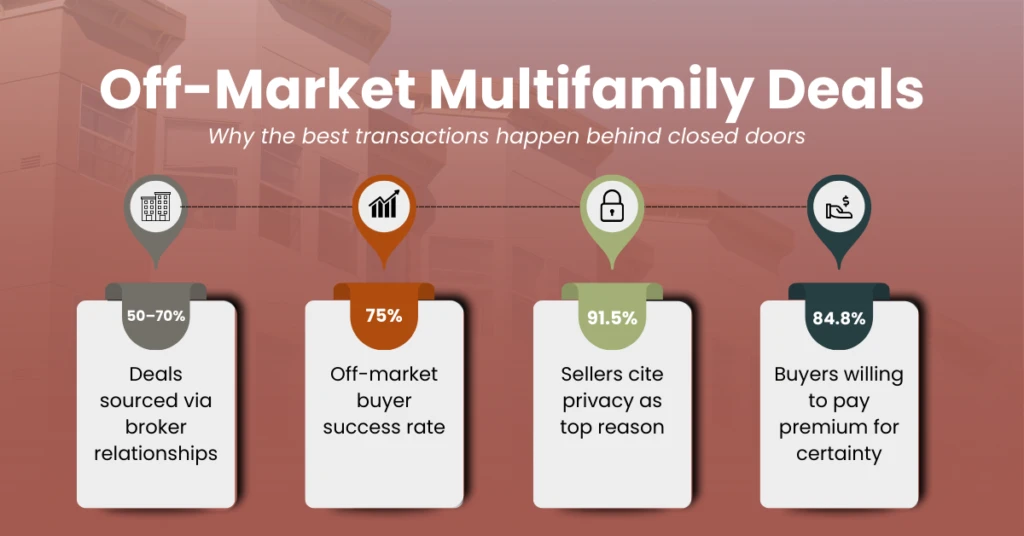

This isn’t just industry folklore. It’s backed by data. According to multiple studies, at least 50% of commercial real estate transactions happen off-market. One German study found that 98% of professional market actors regularly pursue off-market deals. Even in U.S. investor circles, 50–70% of large transactions stem from broker relationships—not public listings.

So why do sellers prefer to keep things quiet? And how do you position yourself to be on the receiving end of those whispered opportunities?

Let’s dig in.

Why Sellers Choose Off-Market Sales

Imagine you’re a multifamily owner. You’ve stabilized your property, improved operations, and now you’re ready to sell. Do you really want to deal with:

- Tenants panicking about a potential sale?

- Competitors snooping through your financials?

- A flood of unqualified buyers wasting your time?

Probably not.

That’s why many sellers opt for off-market transactions. It’s not about secrecy—it’s about control. Sellers want:

- Privacy – 91.5% of surveyed sellers cite discretion as the top benefit. No public exposure, no rumors, no disruptions.

- Speed – Off-market deals move faster. Studies show buyers complete 75% of off-market purchases vs. just 49% of on-market ones.

- Certainty – Sellers complete 68% of off-market deals vs. only 28% of publicly listed ones. That’s a massive gap.

In short, off-market deals offer sellers a smoother, quieter, and more predictable path to closing.

Do Off-Market Deals Really Offer Better Pricing?

Here’s where things get nuanced.

Yes, off-market deals often come with less competition. That’s confirmed across the board. Fewer bidders means less frenzy—and more room for real negotiation.

But “better pricing” depends on your perspective. Research shows that 84.8% of off-market buyers are willing to pay a premium—typically around 5% more than they would in a structured bidding process. Why? Because they value certainty, speed, and access.

So while you might not get a “discount,” you’re often getting a better deal overall: stronger terms, direct negotiation, and a smoother path to closing.

The Power of Relationships

Let’s talk about the real currency in off-market transactions: trust.

Whether you’re sourcing deals through brokers or direct outreach, relationships are everything. Studies show that 80–90% of high-performing brokers maintain warm relationships with clients. And 45–95% of their business comes from repeat clients and referrals.

If you want access to off-market deals, you need to be the investor brokers trust—and the buyer sellers feel comfortable with.

That means:

- Showing up consistently

- Communicating clearly

- Following through on commitments

- Understanding the asset and the seller’s goals

People don’t sell to strangers. They sell to people who get it.

How to Actually Source Off-Market Multifamily Deals

Now let’s get tactical. Because while off-market deals sound great, they don’t just fall into your lap. You have to earn them.

Here’s how top investors consistently uncover off-market opportunities:

-

Build Real Relationships

This isn’t about collecting business cards or sending cold DMs. It’s about showing up—authentically and consistently. Talk to property managers. Attend local meetups. Engage with owners. Ask questions. Share insights. Be the person they remember when they’re ready to sell.

-

Partner with a Broker Who Lives in the Space

A great multifamily broker isn’t just a middleman—they’re a gatekeeper. They know which owners are quietly considering a sale. They understand the nuances of apartment investing. And they can match you with deals that fit your criteria before anyone else hears about them.

If you’re serious about finding off-market properties, this relationship is non-negotiable.

-

Use Data to Drive Direct Outreach

Technology is your friend. Use public records, ownership databases, and digital tools to identify properties that meet your investment goals. Then, reach out—strategically. A well-crafted letter, a thoughtful email, even a phone call can open doors that listings never will.

But don’t be generic. Speak to the owner’s pain points. Offer value. Be human.

-

Stay Visible and Consistent

Off-market sourcing isn’t a one-and-done tactic. It’s a long game. You might plant seeds today that bear fruit six months from now. Stay visible. Stay helpful. Stay ready.

Because when that call comes—“Hey, I’ve got something you might want to look at”—you’ll want to be the investor they trust.

Final Thought: Quiet Deals Build Empires

The biggest wealth-building deals rarely make headlines. They’re whispered about in trusted circles, passed from one savvy investor to another. And they often come with:

- Better terms

- Less competition

- Stronger relationships

- Smoother closings

If you’re tired of chasing deals that feel picked over, off-market is your edge. It’s where real opportunity lives.

So let’s make sure you’re in the room when the next one gets whispered.

Multifamily investing is always evolving—and the investors who win are the ones who stay informed. That’s why I share monthly insights, strategies, and real-world lessons straight to your inbox. Subscribe to our newsletter today to stay updated and get fresh perspective on the multifamily market every month.