The Wake-Up Call for Multifamily Property Owners

Picture this: You’re staring at your portfolio, thinking everything’s fine. But come January 1, 2026, new tax rules kick in, and suddenly your cash flow takes a hit because you didn’t optimize in time. That’s the brutal year-end truth for multifamily property owners: ignoring multifamily year-end strategies now means leaving money on the table. We’ve seen it happen to savvy investors who just got too busy.

The good news? By facing this head-on, you can actually supercharge your property values before the clock strikes midnight on 2025. We’re talking tax savings, operational tweaks, and market positioning that add real dollars to your bottom line. Stick with us, and we will walk you through it like we’re chatting over coffee.

Why Multifamily Year-End Strategies Matter Now

Let’s break down the drivers behind this urgency. First off, tax laws are shifting under the Big Beautiful Bill (BBB), bringing back 100% bonus depreciation for properties acquired after January 19, 2025. If you’re buying or improving multifamily assets, this is your window to deduct the full cost upfront, slashing your taxable income big time.

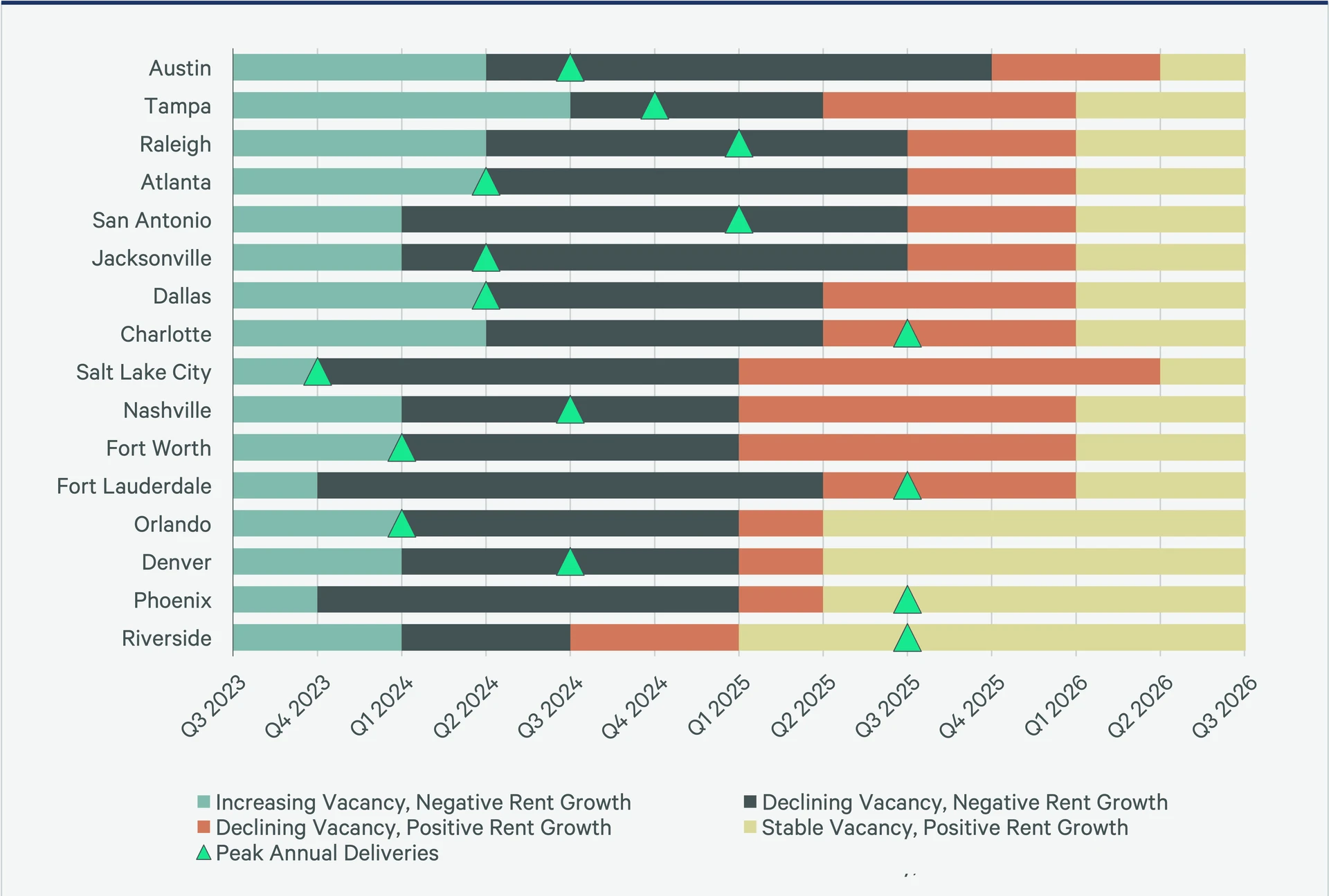

Market dynamics are another big piece. Multifamily supply peaked in 2025, but deliveries are tapering off, setting up a tighter market in 2026. National rent growth is modest at around 1.6%, with vacancies hovering at 6.2%. Without year-end prep, you risk stagnant values or worse, especially if you’re not dialed into multifamily tax planning for 2026.

And don’t forget about the broader economy. Interest rates might stabilize, but affordability pressures persist, pushing owners to rethink strategies. It’s all interconnected and ignoring it is a brutal mistake too many make.

The Real Impacts and Challenges Ahead

Now, let’s get real about the consequences. If you skip multifamily year-end strategies, you could face hefty tax bills. For instance, without leveraging 100% bonus depreciation in 2025, your 2026 deductions drop, hitting your return on equity hard. We had clients regret not acting, ending up with thousands in avoidable taxes.

Market challenges compound this. Vacancy rates are climbing back to normal levels around 6.4% nationally in early 2025 due to oversupply. For multifamily owners, that means tougher competition for tenants, potentially eroding property values if you’re not proactive.

Then there’s the human side. Life events pop up, family stuff, other investments, and suddenly your timeline’s wrecked. One client told us, “I have a big family milestone coming up, and I’m unsure if I can move on the asset now.” That’s a common frustration, turning opportunities into headaches.

Actionable Solutions to Maximize Multifamily Property Value

Alright, enough doom and gloom. Let’s talk about solutions. These multifamily year-end strategies are practical and can transform your portfolio. Start with cost segregation studies. By accelerating depreciation on building components, you front-load deductions and boost cash flow. For a new acquisition, this could mean massive first-year savings.

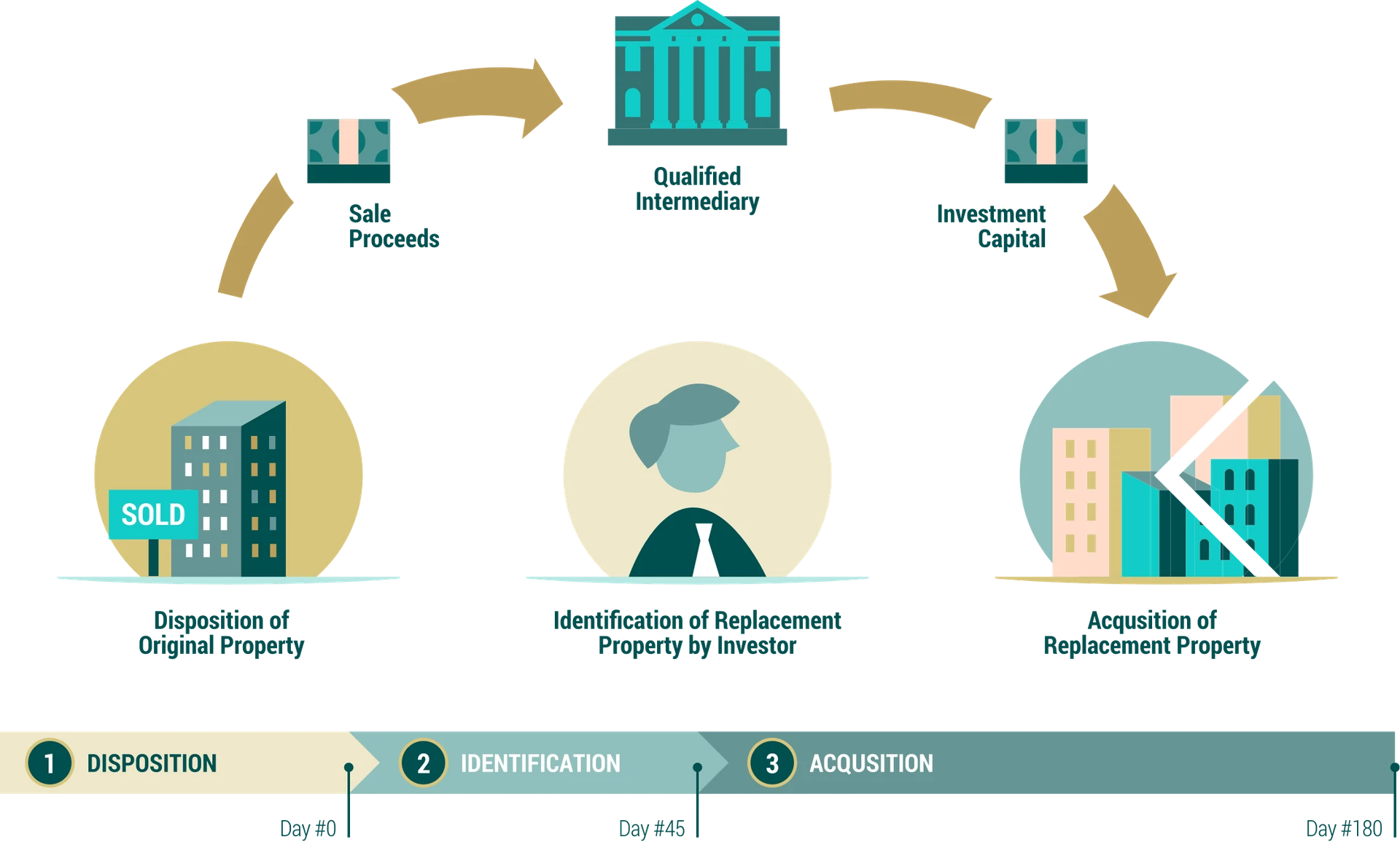

Next, consider a 1031 exchange if you’re disposing of assets. Identify replacement properties within 45 days to defer taxes and scale up. I always recommend lining up options now to avoid year-end rushes.

Operationally, implement Ratio Utility Billing Systems (RUBS) to pass utilities to tenants, adding overlooked income. And don’t sleep on multifamily tax planning like a real estate professional to offset passive losses.

One light-hearted tip: Think of this like tuning up your car before a long trip. Skip it, and you’re stranded; do it right, and you cruise ahead.

The Brutal Year-End Truth (Most Owners Are Ignoring)

2025 has been rough: rent growth barely hit 1.6%, vacancies are stuck at 6–7%, operating expenses (especially insurance) jumped 20–40%, and cap rates are still elevated. Do nothing before December 31 and you’re voluntarily locking in:

- Higher 2025 tax liability

- Missed bonus depreciation on 2025 CapEx

- Weaker negotiating power when the market rebounds in 2026

But here’s what almost no one is talking about: the next 45 days are your last clean shot to flip the script and actually increase property value before the calendar turns.

Five High-Impact Moves Multifamily Property Owners Must Make Before 2026

- Plan Your 1031 Exchange Now. Consider to list that tired asset today, close by year-end, and defer 20–30% capital gains + depreciation recapture. The 45-day identification clock is unforgiving; starting it in January means you’re already behind.

- Harvest Every Remaining 2025 Tax Deduction Pre-pay January 2026 property taxes, insurance, and mortgage interest by 12/31. More importantly, finish any capital improvements before year-end 100% bonus depreciation is back for qualified property placed in service after January 20, 2025, but you can still grab big write-offs on 2025 projects.

- Squeeze 5–10% More NOI in the Next 6 Weeks

- Send renewal increases (even modest ones)

- Implement or expand RUBS/ratio utility billing

- Renegotiate every vendor contract

- Add ancillary income (pet fees, storage, covered parking). A $50k NOI bump at a 6.5 cap adds ~$770k of instant value.

- Stress-Test Your Debt & Lock Rates Early as rates are dropping, but lenders are still requiring 1.20–1.30 DSCR and 65-75% LTV. Get your package together now so you’re first in line when the best loans hit the market in Q1.

- Build (or Upgrade) Your Team Before Everyone Gets Swamped. You need a bulletproof 1031 QI, CPA who lives and breathes real estate, a lender, and a multifamily broker who actually runs the numbers not just throws listings on LoopNet.

What 2026 Actually Looks Like for Proactive Owners

Construction completions are plummeting by 30–40% next year. Supply pressure eases, occupancy climbs, rent growth returns to 3%+, and lower rates make refinancing and acquisition cheaper. Owners who execute their year-end strategy now will capture the entire upside; everyone else will be playing catch-up at higher prices.

Image Source: Multifamily | CBRE

Your Next Move

Here’s the bottom line: year-end 2025 isn’t just about closing out another year. It’s a strategic moment that separates the multifamily property owners who build wealth from the ones who just own buildings.

You now know why this matters, what’s really going on, and what actually works. The only question is whether you’ll act on it.

Start with these priorities over the next 30 days:

Call your CPA this week about cost segregation and year-end property tax strategies, or reach out to us. Walk your property and identify maintenance issues that need immediate attention. Review every service contract and insurance policy for savings opportunities. Look at your tenant roster and make strategic decisions about renewals.

The multifamily property owners who crush it through 2026 won’t be the lucky ones. They’ll be the ones who faced reality, made smart decisions, and took action while others were still thinking about it.

Your property’s value isn’t just about market forces; it’s about the choices you make right now. The clock is ticking in 2025. What are you going to do about it?

Ready to maximize your multifamily investment value? Start by honestly assessing where your property stands today and picking your top three action items. Then get moving.