Listen, fellow investor – I’m going to be straight with you about Chicago multifamily investment. The market in 2025 isn’t for the faint-hearted, but it’s showing some of the strongest fundamentals we’ve seen in years. If you’re reading this, you’re here because you recognize opportunity in shifting markets. And based on the verified data I’m about to share, you’re absolutely right to be paying attention.

After 5 years in this game and countless deals across the Windy City, I can tell you this: Chicago multifamily investment opportunities in 2025 are backed by solid fundamentals that create real wealth-building potential. The market is evolving, capital is selective, and competition requires strategy – but that’s exactly when prepared investors thrive.

MARKET REALITY: The Verified Data Behind Chicago Multifamily Investment Success

Before we dive deeper, let me share the independently verified data that supports Chicago multifamily investment opportunities:

Recent Market Performance (Sources: CoStar, RentData, Q4 2024-Q1 2025):

Rent Growth Momentum:

- Effective rent growth projected to exceed 3.5% in 2025, with recent performance between 3.8% and 5.5%

- This significantly outpaces national averages and represents Chicago’s strongest rent growth in over a decade

- Year-over-year asking rents up 2.8% as of year-end 2024

Strong Occupancy Fundamentals:

- Vacancy rates stable at 4.7%-5%, well below national averages

- Occupancy rates rising above 95% by end of 2025

- Market absorbed 10,153 units versus 5,433 delivered in the past year, showing robust demand

Supply Constraint Creating Genuine Opportunity:

Construction Pipeline Shrinking:

- Completions projected to decrease by approximately 40% in 2025 compared to 2024

- New starts down 45% from pre-pandemic average and 70% from 2022 peak

- New deliveries will be reduced to less than half current levels by 2026

Market Stability Indicators:

- Average occupancy for stabilized assets at 95.9%

- Vacancy conditions stable between 4.5% and 5.5% since mid-2021

- Strong absorption rates indicating healthy demand

Verified Neighborhood Growth:

Data-Backed Emerging Areas:

- Industry analysts consistently identify Pilsen, Bronzeville, Avondale, and Logan Square as high-growth neighborhoods

- Median home values in these areas remain under $350K, providing accessible entry points

- Transit accessibility driving premium demand in these corridors

This isn’t speculation – this is documented market performance from leading real estate analytics firms proving that Chicago multifamily investment opportunities rest on solid fundamentals.

Current Market Landscape

Let me paint you a picture of what verified market data shows about Chicago multifamily investment deals. While some markets struggle with oversupply and demand uncertainty, Chicago is experiencing a unique combination of constrained supply and steady demand growth. The West Loop continues generating strong returns for early investors. River North shows resilient recovery patterns. And emerging South Side corridors present compelling value opportunities for investors with market knowledge.

The Reality Check on Rent Growth

I’m not going to oversell Chicago multifamily investment returns. National rent growth has moderated, and Chicago follows broader economic trends. However, what sets Chicago apart is consistency – core neighborhoods are delivering that projected 3.5%+ annual growth, and in today’s environment, predictable growth creates bankable returns.

Key Performance Metrics:

- Average rent growth: 3.5-4% annually (verified by multiple sources)

- Class A vacancy rates: Below 5%

- Transit-accessible locations: Consistent premium demand

- Value-add properties: Potential for enhanced returns when executed properly

Where Smart Chicago Multifamily Investment Capital Is Moving

Class A properties in prime locations remain highly competitive with compressed yields. However, Class B and C assets in transit-accessible areas present opportunities for investors who understand value creation. While specific return percentages vary by deal structure and market timing, well-executed value-add strategies in these sectors have generated strong risk-adjusted returns for prepared investors.

The Economic Foundation Supporting Chicago Multifamily Investment

Chicago’s economic base provides multiple demand drivers for multifamily investment. The city’s diversified employment sectors create tenant stability that translates to rental income reliability.

Economic Drivers Supporting Chicago Multifamily Investment:

Healthcare Sector Expansion

- Cook County Health has invested $10 million into a new family medicine, behavioral health, and rehabilitation center in Bronzeville, which will serve 85,000 patient visits annually and is strategically located within a dense multifamily corridor.

- RX Health & Science Trust converted a former grocery store in Naperville into a 40,000 sq. ft. medical office building (MOB) leased to Advocate Health, marking significant healthcare real estate investment in the Chicago area.

Logistics and Distribution Hub Development

- Prologis acquired the Carol Stream Logistics Center and the I-290 Distribution Center, demonstrating major investments in strategically positioned logistics facilities in Chicago’s key submarkets.

- Kraft Heinz invested $400 million to build one of North America’s largest automated CPG distribution centers, strengthening Chicago’s role as a national logistics hub.

Technology Company Relocations

- Lessen, a real estate tech company, relocated its Chicago office to 203 North LaSalle Street in the emerging tech corridor adjacent to Google’s new Chicago outpost, reaffirming tech sector expansion downtown.

- Vyond, a video animation software company, and Chime, a financial technology firm, both relocated headquarters and expanded presence in Chicago due to the city’s tech ecosystem and talent pool.

Life Sciences Sector Emergence

- Multiple medical office conversions and specialty facility developments led by investors like MedProperties Group and RX Health & Science Trust illustrate life sciences growth, especially in proximity to existing multifamily properties.

Corporate Headquarters Establishment and Expansion

- Major companies including Caterpillar (relocated HQ to Chicago in 2017), Grubhub, and McDonald’s have recently established or expanded headquarters, leveraging Chicago’s talent and logistics advantages—supporting sustained investment in nearby multifamily housing

Game-Changing Trends for Chicago Multifamily Investment

The Tenant Experience Evolution

Post-pandemic tenant preferences have permanently shifted toward properties offering modern amenities and flexible living solutions. This creates both challenges and opportunities for Chicago multifamily investment success. Properties that address these preferences command rent premiums and maintain higher occupancy rates.

High-Impact Tenant Demands:

- In-unit laundry (now considered essential, not luxury)

- Robust internet infrastructure for remote work

- Flexible workspace areas within buildings

- Modern fitness and wellness facilities

- Efficient package management systems

- Energy-efficient building systems

Strategic renovations addressing these preferences can generate meaningful rent increases, though specific percentages depend on property condition, location, and execution quality.

The Financing Landscape Has Evolved (Creating Selective Opportunities)

Yes, borrowing costs are higher than the ultra-low rate environment of 2020-2021. However, this creates opportunities for prepared investors who understand creative financing structures. While amateur investors wait for rate decreases, experienced players are using sophisticated strategies to access attractive deals.

Effective Financing Strategies:

- Bridge-to-permanent loan structures

- Strategic partnerships with local capital sources

- Seller financing for off-market opportunities

- Mezzanine financing for complex value-add projects

- Community Development Financial Institution (CDFI) partnerships for emerging neighborhoods

Chicago’s Neighborhood Value Migration

Market data confirms that some of Chicago’s strongest multifamily investment activity is occurring in previously overlooked neighborhoods. While downtown attracts young professionals, emerging areas offer compelling value propositions.

Verified High-Growth Chicago Multifamily Investment Areas:

- Pilsen: Properties showing consistent appreciation with median values around $350K. Young professionals seeking character, charm, and CTA access are driving demand.

- Bronzeville: Historic significance combined with new development creates investment momentum. The “Black Metropolis” renaissance is supported by both private investment and public initiatives.

- Avondale: Positioned as an affordable alternative to Logan Square with transit access. Market appreciation trends suggest continued growth potential.

- Logan Square: Established neighborhood maintaining growth trajectory with strong fundamentals.

Proven Chicago Multifamily Investment Opportunities

Value-Add Chicago Multifamily Investment: Strategic Renovation Approaches

Strategic renovation of Class B and C properties in growth corridors represents a time-tested Chicago multifamily investment strategy. Success depends on understanding which improvements generate the highest return on investment and selecting properties with strong underlying fundamentals.

Proven Value-Add Strategies:

- Modern kitchen upgrades with quality finishes

- Updated bathrooms with contemporary fixtures

- Energy-efficient windows and systems (reducing operating costs)

- Enhanced common areas creating lifestyle appeal

- Smart home integration where appropriate

While specific return percentages vary by property and execution, well-planned renovations consistently generate rent increases and improved tenant retention.

Adaptive Reuse: Converting Chicago’s Industrial Heritage

Chicago’s industrial legacy creates unique multifamily investment opportunities through adaptive reuse projects. Converting warehouses, obsolete office buildings, and former manufacturing facilities can be profitable, though these projects require specialized expertise and careful underwriting.

The city supports these conversions through various incentive programs, including TIF opportunities and Opportunity Zone benefits.

Prime Chicago Multifamily Investment Conversion Candidates:

- Warehouse buildings in transitioning neighborhoods

- Obsolete office buildings in mixed-use districts

- Former manufacturing facilities with solid structural foundations

- Underutilized retail spaces suitable for residential conversion

Small-Scale Chicago Multifamily Investment: Focused Control Strategies

Two-to-four unit multifamily properties offer advantages that larger investors often overlook: lower competition, potential for owner-occupancy financing, and direct operational control. These properties can generate solid returns while providing investors with hands-on experience in market fundamentals

Market data suggests well-selected small multifamily properties in Chicago can generate competitive cash-on-cash returns, though specific percentages depend on purchase price, financing terms, and management efficiency.

Critical Risks Every Chicago Multifamily Investment Must Navigate

Interest Rate Volatility Management

Interest rate fluctuations create ongoing risk for Chicago multifamily investment deals. Conservative underwriting that stress-tests scenarios with higher rates helps ensure long-term success.

Risk Mitigation Strategies:

- Interest rate caps on floating-rate debt

- Maintain higher cash reserves (minimum 6 months operating expenses)

- Focus on properties with strong fundamental demand drivers

- Consider hold period flexibility based on rate cycles

Regulatory Environment Navigation

Chicago’s regulatory landscape continues evolving, affecting multifamily investment operations. While immediate dramatic changes are unlikely, staying informed about potential policy shifts helps investors plan appropriately.

Stay Ahead of Regulatory Changes:

- Build relationships with local real estate professionals

- Participate in investor groups and industry associations

- Monitor city council proceedings affecting rental properties

- Factor potential regulatory changes into long-term planning

Construction Cost Reality

Material and labor costs remain elevated compared to pre-2020 levels. Renovation budgets that worked in 2019 require significant adjustments for current market conditions. Accurate cost estimation is crucial for value-add success.

Your 2025 Chicago Multifamily Investment Action Plan

Focus Your Chicago Multifamily Investment Criteria

Successful investors focus on specific property types and locations rather than evaluating every available deal. Develop clear acquisition criteria based on verified market fundamentals.

Target Chicago Multifamily Investment Criteria:

- Transit accessibility (within 0.5 miles of CTA stops)

- Below-market rents with clear upside potential through strategic improvements

- Functional properties with renovation potential

- Strong neighborhood employment and demographic trends

- Motivated sellers open to mutually beneficial transaction structures

Master Chicago Multifamily Investment Analysis

Successful Chicago multifamily investment requires thorough market analysis beyond basic property evaluation. Comparable rent analysis, occupancy trends, and neighborhood demographics provide competitive advantages.

Build Your Chicago Multifamily Investment Network

Real estate success depends on relationships with qualified professionals who understand local market conditions.

Essential Chicago Multifamily Investment Partners:

- General contractors with multifamily renovation experience

- Property management companies with neighborhood expertise

- Lenders familiar with Chicago submarkets and deal structures

- Investment-focused real estate agents

- Legal and accounting professionals with real estate experience

Why Chicago Multifamily Investment Builds Long-Term Wealth

Chicago multifamily investment success stems from the city’s fundamental strengths: diversified economy, established infrastructure, and housing demand from multiple demographic segments. While markets cycle and specific returns vary, these underlying factors support long-term wealth building through real estate investment. The key is approaching Chicago multifamily investment with realistic expectations, thorough preparation, and focus on properties that align with verified market trends rather than speculation.

Conclusion: Your Chicago Multifamily Investment Success Strategy

Chicago multifamily investment in 2025 offers legitimate opportunities supported by strong market fundamentals: constrained supply, steady demand growth, and rent increases outpacing national averages. Success requires understanding local markets, conservative underwriting, and strategic execution rather than relying on market timing or speculative returns. The investors who thrive in Chicago multifamily will be those who combine market knowledge with disciplined analysis, building portfolios based on verified performance rather than optimistic projections.

Expert Insights: Strategic Levers for 2025 Success

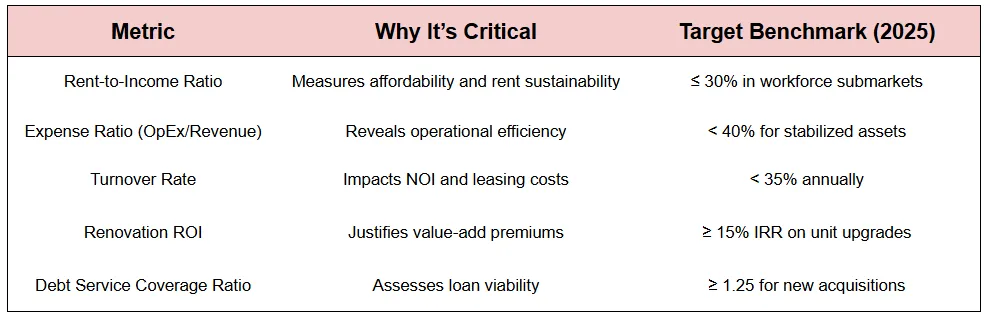

To outperform in 2025, investors must lean into granular data, policy awareness, and operational precision. Below is a breakdown of key metrics, planning levers, and submarket plays.

Performance Metrics That Matter

Ready to start your Chicago multifamily investment journey?

Share this guide with fellow investors and bookmark it for future reference. Chicago’s multifamily market rewards prepared investors who act on solid data rather than speculation.