In Chicago’s ever-evolving real estate landscape, multifamily property owners frequently ask us, “Is now the right time to sell?” The answer isn’t one-size-fits-all; it depends on current real estate market timing, economic factors, and your unique investment goals. As specialists in selling apartment buildings and analyzing Chicago multifamily market trends, we provide this analysis to help owners make informed decisions and maximize their investment returns.

Current Chicago Multifamily Market Trends (2024–2025)

Chicago multifamily market trends continue to reflect remarkable resilience despite economic headwinds. Understanding these dynamics is essential when considering whether now is the right time to sell apartment buildings in the dynamic Chicago MSA.

Key trends we’re observing include:

- Limited inventory and a declining construction pipeline are creating competitive market conditions, with multifamily construction at historic lows.

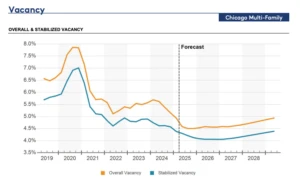

- Strong rent growth and sub-5% vacancy rates in hot submarkets like West Loop and River North, fueled by demand from young professionals and expanding tech and healthcare employment.

- Properties with strong financials and minimal deferred maintenance are experiencing compressed days-on-market.

- Varying submarket performance, especially in transit-oriented areas, underscores the need for localized strategies.

Recent regulatory shifts influence real estate market timing decisions, such as changes to the Affordable Requirements Ordinance, property tax reassessments, and 2025’s new tenant protection laws. These changes have pushed some owners toward divestment while offering new opportunities to buyers with long-term visions and compliance know-how.

Economic Indicators Influencing Real Estate Market Timing

Macro-level factors currently shaping the Chicago multifamily market trends include:

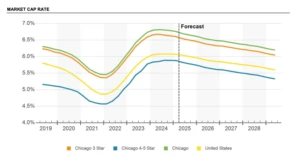

- Interest rate environment: Rates have stabilized rather than declined significantly, remaining elevated compared to historic lows, which impacts buyer financing capabilities and purchase decisions.

- Inflation concerns: While moderating, inflation continues to significantly impact operating costs and net operating income, requiring strategic management approaches to maintain profitability.

- Employment growth: Chicago’s diversified economy continues adding jobs at a moderate but positive pace, supporting rental demand and occupancy rates across most submarkets.

- Capital markets liquidity: Institutional and private capital, including significant out-of-state investment, remains available for quality multifamily assets despite Chicago’s population challenges, as investors recognize the market’s institutional investment appeal.

Forecasts suggest continued stability in 2025, presenting a potential window of opportunity for selling apartment buildings before any economic headwinds emerge. Inventory constraints and continued rent growth make this an advantageous time for well-positioned sellers.

Signs It’s the Right Time to Sell Your Apartment Building

While market conditions matter, your specific circumstances often determine the optimal timing for a sale. Consider these indicators that might suggest now is an appropriate time to exit your multifamily investment:

- Portfolio rebalancing needs: Your investment allocation may benefit from diversification or consolidation based on your broader financial strategy.

- Return thresholds achieved: You’ve reached or exceeded the property’s initial investment return objectives.

- Lifecycle positioning: The property requires significant capital improvements that a new owner with different expertise or resources may better undertake.

- Tax planning opportunities: Current market conditions align with your tax minimization strategy, potentially including 1031 exchange considerations.

Well-timed exits often occur when personal financial goals intersect with favorable real estate market timing, rather than attempting to predict the market’s exact peak.

Risks of Waiting in Today’s Multifamily Market

While patience can be virtuous in real estate investing, delaying a planned sale in the current market environment carries several potential risks:

- Interest rate sensitivity: While rates have stabilized, they remain elevated, and any future increases could further compress buyer purchasing power and potentially reduce achievable sale prices.

- Rising construction costs: In the current inflationary environment, deferred maintenance becomes increasingly expensive to address, potentially reducing net proceeds upon eventual sale.

- Changing tenant preferences: Post-pandemic renter requirements continue evolving toward amenity-rich, transit-accessible properties, potentially requiring significant repositioning for older assets.

- Future development cycles: While construction is currently at a low point, development could accelerate in coming years as economic conditions improve, potentially creating future competitive pressures in certain submarkets.

Uncertainty around Chicago’s evolving property tax framework also risks holding strategies, reinforcing the importance of a proactive approach to selling apartment buildings.

How to Maximize Value When Selling

Regardless of when you decide to sell, these preparation strategies can significantly enhance your property’s marketability and value:

- Financial documentation optimization: Ensure rent rolls, operating statements, and capital expenditure history are thoroughly documented and professionally presented, with special attention to demonstrating strong rent growth potential.

- Strategic improvements: Implement targeted property enhancements with demonstrable ROI rather than comprehensive renovations that may not fully recoup costs, focusing on amenities that appeal to today’s renters.

- Lease structure review: Optimize existing leases to maximize property value while ensuring compliance with Chicago’s latest tenant protection ordinances and transparency requirements.

- Professional valuation: Obtain a comprehensive broker opinion of value, specifically accounting for Chicago’s unique submarket characteristics, with particular attention to transit-oriented and mixed-use development advantages.

- Market timing alignment: Consider aligning your sale with the current low construction pipeline to maximize competitive advantage before new development cycles begin.

Specialized multifamily brokers with deep knowledge of Chicago’s market trends can uncover hidden value, especially in well-connected, mixed-use, and transit-accessible locations.

Next Steps: Evaluate Your Investment Strategy

If you’re exploring whether now is the right time to sell, we recommend:

- Requesting a confidential valuation to determine the current market value.

- Reviewing your portfolio strategy to identify alignment opportunities.

- Outlining a customized exit plan that matches market conditions and investment goals.

- Explore reinvestment options like a 1031 exchange or DST (Deferred Sales Trust) to defer taxes.

At DS Property Experts, we specialize in selling apartment buildings across Chicago. Our deep understanding of the Chicago multifamily market trends and expert guidance on real estate market timing empower owners to make decisions that protect and grow their wealth.

Whether you’re ready to sell or planning for the future, contact our multifamily advisory team for a confidential strategy session. We’ll help you assess whether today’s market supports your goals and develop a tailored plan to unlock the full value of your Chicago multifamily property.